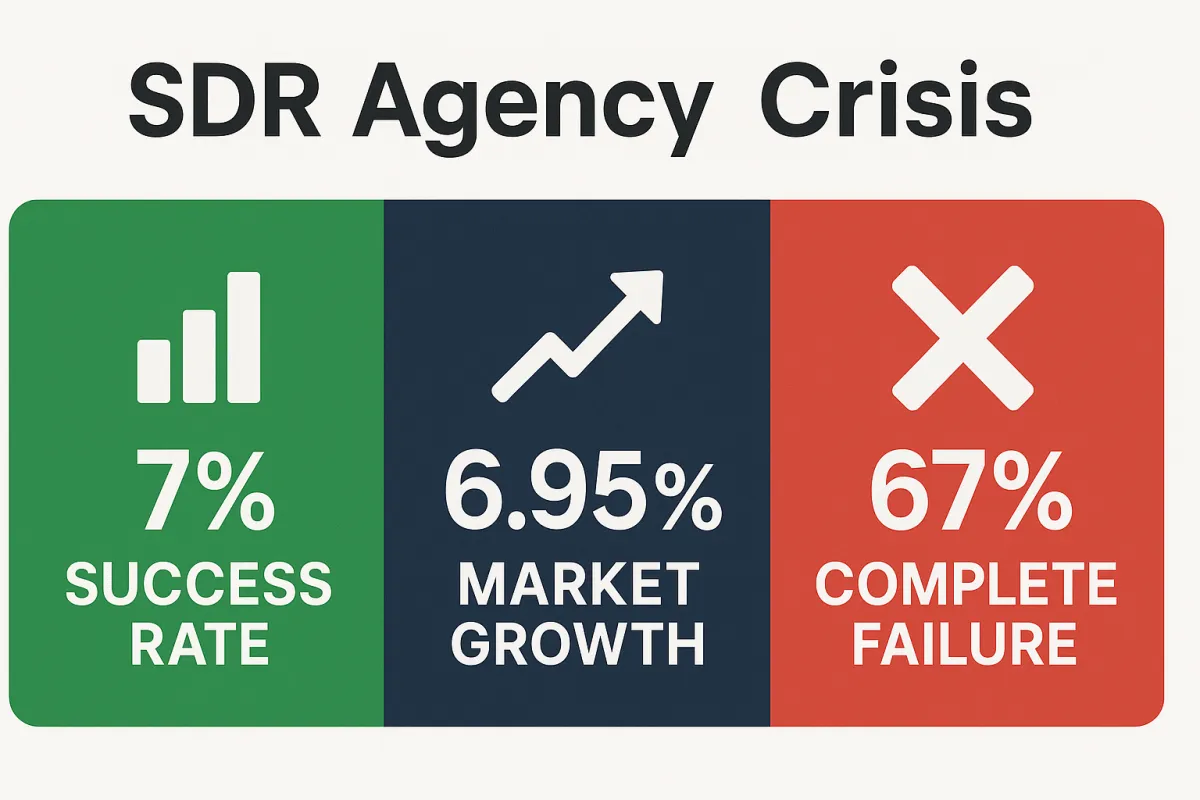

The SDR Agency Reality Check: Why Do Only 7% of SDR Agency Engagements Succeed While the Market Keeps Growing at 6.95% Annually?

For agency CEOs and sales development leaders, the Sales Development Representative (SDR) agency industry presents a striking contradiction. According to a SaaStr survey of over 1,200 respondents, only 7% of companies have "really gotten outsourced SDRs to work," while another 26% say it "sort of worked"¹(Saastr). Yet, the global outsourced sales services market continues expanding at a steady compound annual growth rate of 7%, with projections indicating sustained demand for outsourced sales development and lead generation services².

This isn't just theory for me. I learned this painful reality firsthand as interim Chief Revenue Officer (CRO) for a cloud integration and development consultancy in 2020. After 9 months and significant investment in a 2-SDR program, we didn't close a single deal. Here's why that 67% failure rate isn't just a statistic—it's a predictable outcome in the world of outsource sales development.

This paradox highlights a core value-delivery crisis threatening agency survival, but it also exposes a major opportunity: with a 67% complete failure rate, there is huge potential for agencies that can achieve what 93% cannot. The fundamental question is whether your agency will lead the transformation or risk becoming obsolete in the competitive SDR agency landscape.

Although a full resolution is elusive, there is a significant step forward I want to put on the table—keep reading to see what it is.

The 93% failure rate signals a market waiting for agencies capable of delivering what clients truly need: qualified meetings that convert to revenue, not just activity metrics. In this analysis, you'll see exactly what this looks like in practice for SDR agencies, sales outsourcing providers, and outsourced sales development teams.

Is Market Growth Masking a Client Satisfaction Crisis?

Why Do Most Outsourced SDR Programs Fail to Deliver Results?

Jason Lemkin, founder of SaaStr, summarizes the challenge: "What I personally haven't seen is an outsourced SDR team replace an in-house one. It would be great if it could, especially given the high turnover rate in SDRs. I just haven't yet seen it work"¹ (SaaStr). This is a tough verdict from a top SaaS industry expert and explains why prospects remain skeptical, even with apparent cost advantages offered by outsourced sales agnecies.

"What I personally haven't seen is an outsourced SDR team replace an in-house one. It would be great if it could, especially given the high turnover rate in SDRs. I just haven't yet seen it work." — Jason Lemkin, Founder of SaaStr

The economics should favor sales development agencies. Outsourced SDR services cost significantly less than in-house teams and promise faster ramp times with experienced sales talent. Yet, SaaStr's survey shows that 67% of outsourced SDR attempts fail, indicating fundamental flaws in agency value delivery rather than client expectations or market demand.

Performance Reality: Why Are Even Modest Expectations Unmet?

What Makes SDR Agencies Struggle With Client Retention and Success?

Industry performance metrics reveal why agencies struggle to retain clients, even when technical benchmarks are met. Gartner research shows it takes 18+ dials to connect with a prospect by phone, and only about 24% of sales emails are opened³(Gartner). These connection challenges are magnified for outsourced SDR teams, who often lack the deep product, persona knowledge, and cultural integration of internal staff.

From my 2020 SDR agency experience, the first challenge hit immediately: our SDRs spent months just learning to be competent, let alone confident in basic SDR skills, our target persona pain points, and our solution offerings. Both the agency SDR manager and I provided coaching when we could, but time was limited to short bursts. Despite our efforts, the SDRs never developed the industry insights needed to sound relevant to C-level decision makers. To prospects, they probably sounded like "just another 20-something cold caller interrupting my day." I still wonder...how many qualified buyers did we miss during those months?

For agencies serving smaller clients, the performance bar is low but still hard to reach. Enterprise-focused agencies aim for 15+ meetings monthly, while those with SMB clients would celebrate 2–3 quality meetings per SDR each month. Yet this modest goal remains elusive without product expertise and client context.

The Activity Trap: Why Do Good People Produce Poor Results?

The core problem isn't that SDRs or Account Executives (AEs) are lazy or incompetent—it's that the system incentivizes the wrong behaviors. SDRs are typically measured on activity metrics: calls made, emails sent, meetings booked, meetings held. When your performance review depends on hitting 100 dials per day, spending 15 minutes researching prospects becomes a luxury you can't afford. The math is brutal: deep research might improve conversion rates, but it destroys SDR activity numbers.

AEs face a similar dilemma. When only 60-80% of booked meetings actually show up, and a fraction turn into qualified opportunities, is it rational to spend 30 minutes preparing for each meeting? I get it. From an AE's perspective, they're better off taking the meeting cold and using their selling skills to adapt in real-time. The time investment in preparation often doesn't correlate with meeting outcomes—especially when the prospect research was minimal to begin with.

The conversion crisis is acute for agencies. Top sales teams convert 59% of sales qualified leads to opportunities, with a 20% or better close rate expected⁴(Gartner). These benchmarks set client expectations, but outsourced SDRs must deliver without the institutional knowledge of internal teams—and within systems that reward speed over depth.

In that same engagement, even when our SDR did book meetings, the hold rate was poor because prospects weren't genuinely excited about the discussion. They'd agreed to a meeting out of politeness or curiosity, not genuine interest. But the SDR had already moved on to the next prospect—because that's what the activity metrics demanded.

The talent crisis adds vulnerability. Industry replacement costs for an SDR can reach $100,000 when accounting for recruitment, training, and lost productivity⁵⁻⁶(SalesHive, Martal). With agency profit margins typically at 15–20%, losing one SDR can erase profit from several client relationships, making talent turnover an existential risk for sales development agencies.

The Desperate Search for Agency Differentiation

Why Do 83% of AI SDR Implementations Fail to Deliver Value?

Facing pressure to differentiate, agencies are racing to adopt new technologies and strategies. Many recognize Artificial Intelligence (AI) will be transformative—improving qualification, ramp times, and personalization at scale. Yet, most initial AI SDR implementations fail.

A recent SaaStr survey found 83% of companies say their AI SDR efforts haven't worked⁷(SaaStr). The problem isn't AI adoption—it's how it's adopted. Agencies often pursue superficial AI integrations that don't solve core workflow issues.

The Band-Aid Approach:

ChatGPT integrations for email templates that remain generic

Basic automation tools that speed up broken processes

AI prospecting add-ons that increase volume, not quality

Technology that amplifies existing problems

The Real Challenge: Surface-level AI perpetuates the volume-over-quality trap that damages agency credibility. When agencies use AI to help SDRs send 500 emails per day instead of 50, they're not solving the problem—they're making it worse. This volume-first approach forces prospects to become increasingly defensive, ignoring even great solutions that could solve significant problems. The entire market becomes less receptive as a result.

The irony is that AI could solve the research time problem—but only if agencies redesign their metrics and workflows. Instead of using AI to send more generic outreach, smart agencies use AI to make research scalable, allowing SDRs to be both productive AND relevant.

Smart agencies now realize true AI transformation means rebuilding workflows around quality and relevance, not just adding automation to increase activity. The question: is your agency pursuing AI for differentiation or just contributing to prospect fatigue?

The Specialization Paradox: Should Agencies Focus or Stay Broad?

Forward-thinking agencies face a tough choice: specialize for premium positioning or keep broad market reach. Data strongly supports specialization, but the strategic implications can cause paralysis for many sales outsourcing firms.

Vertical specialization allows agencies to command premium pricing by developing deep domain expertise. Healthcare-focused agencies understand compliance; fintech agencies speak the CFO's language; SaaS agencies know technical buyer personas. These specialized agencies outperform generalists on quality and client retention.

Back to my 2020 SDR agency engagement, when we identified an additional target segment, the entire learning curve started over. The SDRs had spent weeks, learning new persona, industry care-abouts, and talk tracks. New industry, new personas, same problems.

The Paradox: Specialization improves results and pricing but seems to shrink the addressable market. This creates fear in agencies of committing to verticals, even though generalization commoditizes services.

The Hidden Solution: Advanced AI tools now enable rapid domain expertise development. Agencies can become "specialized at scale," building vertical knowledge quickly enough to serve multiple industries with expert-level competence. More on this later.

Revenue Partnership Evolution: How Agencies Move Beyond Lead Generation

How Are Agencies Evolving From Meeting Bookers to Revenue Partners?

Leading agencies are transitioning from lead generators to revenue partners, recognizing they can't drive outcomes by controlling only the top of the funnel. Agencies often get blamed for poor conversion rates even when the client's account executives or sales processes are at fault.

Here's where it got worse in my SDR agency experience: our SDR would send a basic qualification email to the AE—essentially checking boxes on budget, timeline, and authority—but nothing to help the AE actually convert the prospect to an opportunity. The meeting would creep up on my AEs, who'd "wing it" with their standard company overview and services pitch, having no real insight into the prospect's specific situation or likely pain points.

But here's the key insight: this wasn't because our AE was lazy or unprepared. When 40% of meetings don't show up and another 40% turn out to be unqualified, spending significant prep time on each meeting feels like wasted effort. The AE was making a rational decision based on historical patterns. The system was broken, not the people.

This frustrated everyone—the SDR who worked hard to book the meeting, the AE who couldn't convert using their usual approach, me watching my ROI disappear, and eventually the agency failing to renew our engagement.

Traditional Model Problems:

SDRs book meetings, AEs convert (or not)

Agencies control qualification, clients control conversion

Success depends on uncontrollable variables

Results attribution becomes a finger-pointing exercise

Misaligned incentives reward activity over outcomes

Revenue Partner Evolution: Innovative agencies expand services to control more conversion variables:

AE enablement: Detailed meeting prep and prospect research for client sales teams

Conversion playbooks: Training programs for client AEs to capitalize on meetings

Sales process optimization: Helping clients improve post-meeting workflows

Marketing integration: Nurturing strategies before and after meetings

Technology integration: Tools that improve the entire revenue cycle

Metrics alignment: Shifting from activity-based to outcome-based measurement

This isn't just service differentiation—it's a survival strategy. By taking responsibility for conversion outcomes, not just meeting volume, agencies can escape the "fake meeting" trap that damages industry credibility.

Consider agencies that provide not just a qualified meeting, but also:

Comprehensive prospect research that makes AE prep convenient and worthwhile

Suggested talk tracks tailored to the buyer

Insightful follow-up sequences

Training or job aids for AEs on handling specific buyer types

Quality guarantees that justify AE time investment

These agencies control more conversion variables, enabling them to better deliver predictable outcomes, not just activities.

The Platform Agency Future: Will AI or Humans Win the Sales Race?

AI vs. Human SDRs: Which Sales Model Delivers Sustainable Results?

Market forces are creating a split: agencies will either evolve into integrated revenue platforms or be replaced by AI automation. The rise of AI-powered sales development is both a threat and an opportunity, depending on agency strategy.

The Threat: Basic SDR functions are being automated with "volume-first AI." These platforms can send thousands of personalized emails daily, versus 50–100 for humans, at a fraction of the cost. Early adopters report 10x cost-effectiveness—but they're measuring the wrong thing. When everyone uses AI to spam prospects with higher volumes of mediocre outreach, the entire market becomes less responsive.

The Opportunity: The agencies that win use "intelligence-first AI"—technology that makes each interaction more relevant rather than just more frequent. Instead of using AI to send 10x more emails, they use AI to make each email 10x more informed.

The Critical Difference:

Volume-first AI: Automates bad processes faster (more generic emails, higher activity metrics, worse prospect experience)

Intelligence-first AI: Transforms processes to be better (deeper research, contextual messaging, improved conversion rates)

Leading agencies are investing heavily in technology stacks—proprietary CRM integrations, AI-powered prospect research tools, and automated sequence platforms. The smart ones use these tools to solve the time constraint problem: AI handles the research, humans handle the strategy and relationship-building.

Winning agencies provide what volume-first AI cannot: complex situation analysis, nuanced buyer psychology, and seamless sales process integration. They use AI to make research scalable, allowing SDRs to be productive without sacrificing relevance, and giving AEs research-rich handoffs that justify preparation time.

The result: While competitors race to send more emails, intelligence-first agencies send fewer, better-researched messages that prospects actually want to receive.

After that 2020 agency experience, I definitely got better at ramping SDRs and their managers in subsequent agency partnerships and in-house SDR teams. And, agencies have improved too. But the fundamental challenges that create lackluster results remain. Most companies that don't achieve ROI won't try SDR agencies again—and that's the real issue for agencies: client churn and high customer acquisition costs.

That experience taught me why the 93% failure rate isn't surprising—it's systemic. The problem isn't people; it's incentive structures that reward the wrong behaviors. Yet, this frustration is also opportunity. Agencies that solve these core issues—aligned metrics, research efficiency, real conversion support—will win outsized value in a market hungry for real results.

The Multi-Dimensional Challenge: Why Agency Success Requires Systematic Change

The 7% success rate isn't just about one missing piece—it reflects the complex reality that agencies face daily. The agency leaders I work with are simultaneously managing talent acquisition in a competitive market, optimizing technology stacks, refining client onboarding processes, and adjusting pricing strategies. These are sophisticated operations run by smart, hardworking teams who understand that sustainable growth requires excellence across multiple dimensions.

The Complete Agency Transformation Stack:

✅ Talent acquisition and retention systems

✅ Client onboarding and expectation management

✅ Technology stack optimization and incorporating AI tech

✅ Pricing and positioning strategy

🎯 Prospect intelligence integration ← Critical leverage point

✅ Client AE enablement and conversion support through playbooks and other assets

✅ Metrics realignment and reporting for attribution

The challenge isn't that agencies lack sophistication—it's that even excellent execution across these areas can be undermined by one critical gap: the quality of prospect intelligence that determines whether meetings convert.

Your team's investment in talent, technology, and processes deserves research quality that matches that effort. When SDRs can quickly access strategic context and AEs receive intelligence that justifies preparation time, all the other operational excellence starts paying dividends.

Beyond Lead Generation: Why Prospect Intelligence Amplifies Everything Else

Complete agency transformation requires AI integration, revenue partnership expansion, operational restructuring, and talent development. But one shift delivers immediate results: prospect intelligence.

"The 7% success rate isn't an industry limitation—it's a market opportunity." — Matt Oess

Top-performing agencies realize the problem isn't SDR activity—it's SDR intelligence. When your SDR books a meeting, what does your client's AE actually know about that prospect?

Most agencies hand off basic notes: company size, budget, timeline. The best provide strategic intelligence: specific business challenges, recent company changes, prospect insights, tailored conversation starters, and predictable pain points.

This is a different business model. Instead of selling meeting volume, you're selling meeting outcomes. More importantly, you're providing research so valuable that AEs want to prepare because the intelligence justifies the time investment.

For example: Your SDR books a meeting with a healthcare CFO. The traditional handoff gives the AE: "CFO at 500-person healthcare company, interested in cost reduction, budget approved for Q1." The prospect intelligence approach provides: "CFO facing new Medicare reimbursement cuts, company just acquired two clinics, likely concerned about operational efficiency, competitors implemented similar solutions with 15% cost savings."

Which AE is more likely to succeed? More importantly, which AE is more likely to spend a few minutes preparing for the meeting?

AI can now analyze company news, industry trends, and role-specific challenges in minutes. The barrier isn't capability—it's implementation. By using AI to make research scalable, agencies can solve both the SDR productivity problem and the AE preparation problem.

Forward-thinking agencies are making Prospect Intelligence a core offering. They're training SDRs to gather strategic context and using AI tools for research at scale. Most importantly, they're positioning themselves as revenue partners who control conversion variables, not just activity metrics.

The result: when meetings convert, clients renew. When you control outcomes, you can price accordingly. Solve the core problem, and demand will find you.

🎯 Want to See Prospect Intelligence in Action?

The 7% success rate is a massive market opportunity for agencies that can deliver meetings that convert to revenue, not just calendar appointments.

Want to see Prospect Intelligence in practice? I can show you by way of example. Here's my offer:

Choose a B2B client that complains about quality but hasn't churned.

Send me the contact details for the next 2 booked meetings your SDR creates.

I'll create the strategic brief your client's AE should receive.

No pitch, no strings attached. I want you to see how better prospect research elevates conversation quality.

You'll get a prospect analysis with predicted pain points, tailored solution recommendations, strategic discovery questions, and conversation guidance—the same intelligence that helps agencies shift from the 93% failure group to the 7% success category.

→ Email the prospect details to [email protected]. Let's prove whether better intelligence drives better outcomes.

The transformation from 7% to 50% starts with agencies like yours taking the first step. Two contacts. Two minutes.

Key Takeaways

Market Opportunity: High SDR agency failure rates signal untapped potential for agencies that successfully address core value gaps.

System Problem: Misaligned incentives and flawed workflows drive poor results despite individual effort.

AI Integration: Surface-level AI adoption fails; true improvement comes from workflow transformation and quality focus.

Specialization at Scale: Combining industry expertise with AI enables agencies to serve more industries with depth.

Revenue Partnership: Agencies must control conversion variables and outcomes, not just book meetings, to escape the "fake meeting" trap.

Conclusion

To become a dominant SDR agency, focus on delivering qualified meetings that convert by integrating prospect intelligence, AI-powered workflows, and outcome-based partnerships—proving real value that clients can measure while solving the systemic incentive problems that cause good people to produce poor results.

FAQs

Why do 67% of SDR agencies fail their clients?

The main failure points aren't individual incompetence but systemic issues: SDRs are measured on activity metrics that discourage deep prospect research, while Account Executives (AEs) rationally avoid meeting prep when most appointments don't convert. When incentives reward volume over quality, even talented people produce poor results. Agencies that succeed realign metrics and use AI to make quality research scalable.

What is the average cost of SDR agency failure?

Agency failure leads to client churn, lost expansion opportunities, and eliminated referrals. Losing a major client means expensive SDR and client replacement efforts, delayed revenue, and damaged reputation. In a market where only 7% of agencies succeed, breaking the churn cycle is vital for growth.

How can agencies use AI to improve success rates and avoid the 67% failure trap?

Effective AI implementation solves the time constraint problem by making research scalable. Instead of using AI to increase email volume, smart agencies use AI to provide deep prospect intelligence quickly, allowing SDRs to ramp much more quickly, and be productive while increasing relevancy to prospects. This gives AEs research so valuable that meeting preparation becomes worthwhile, improving conversion rates.

Why do unprepared AEs cause agency relationships to fail?

AEs aren't unprepared due to laziness—they're making rational decisions. When 40% of meetings don't show up and another 40% aren't qualified, extensive prep time feels wasteful. The solution isn't demanding more preparation; it's providing research so valuable that AEs want to prepare because the intelligence justifies the time investment.

How do I access the free Prospect Intelligence analysis?

Choose a B2B client that complains about quality but hasn't churned, and email the next two booked meeting details to [email protected] along with the client's URL. You'll receive a strategic brief, showing how Meeting Intelligence transforms preparation and conversion rates—no pitch, just proof.

Sources

SaaStr Survey, "Only 7% of You Have Really Gotten Outsourced SDRs to Work," Jason Lemkin

Verified Market Research, "U.S. Outsourced Sales Services Market Size & Forecast"

Gartner, "Sales Development Technology: The Stack Emerges"

Gartner, "Sales Development Metrics: Assessing Low Conversion Rates"

SalesHive, "The True Cost of an SDR (Sales Development Rep)"

Martal, "SDR Salary Guide: Real Costs vs. Outsourced Savings"

SaaStr, "83% Percent of You Haven't Gotten AI SDRs to Work… Yet," Jason Lemkin